Is the average American family finding it difficult to increase their discretionary spending?

This is a critical question for the economy since almost 70% of U.S. economic growth (GDP) is driven by consumer spending. If consumer spending slows, expect the economy to slow down with it.

Some signs are emerging that this is already occurring.

For instance, retails sales had an unexpected decline for 3 months in a row, from December 2017 to Feb 2018 (Graph 1). Although they have recovered in the last 2 months, first quarter 2018 same store sales were below expectations for many retailers including JC Penny, Target, Lowes, Home Depot, Nordstrom, Wal-Mart and Auto Zone. Why isn’t consumer demand stronger given that the unemployment rate is at an 18 year low and household wealth is at an all-time high?

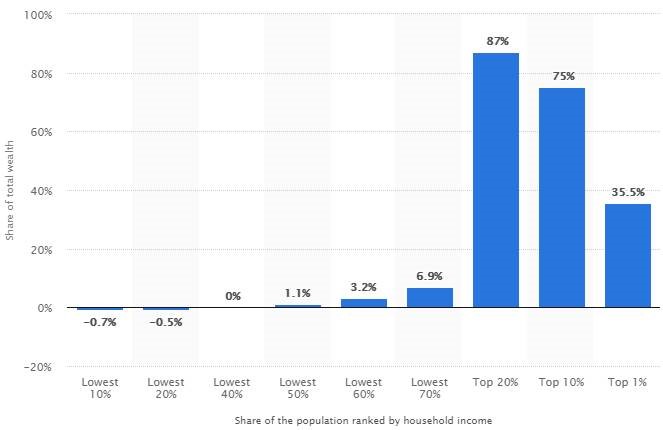

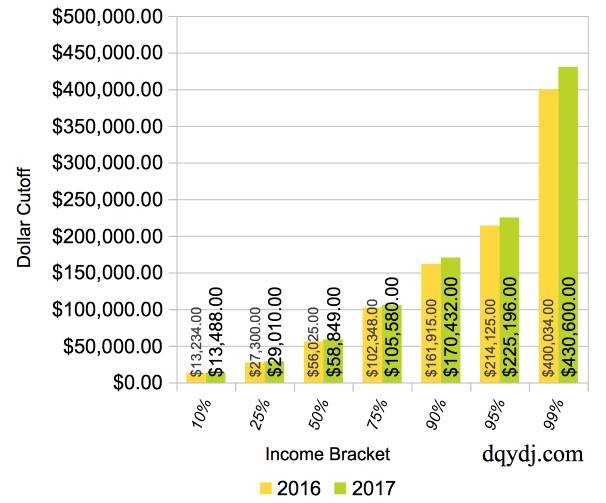

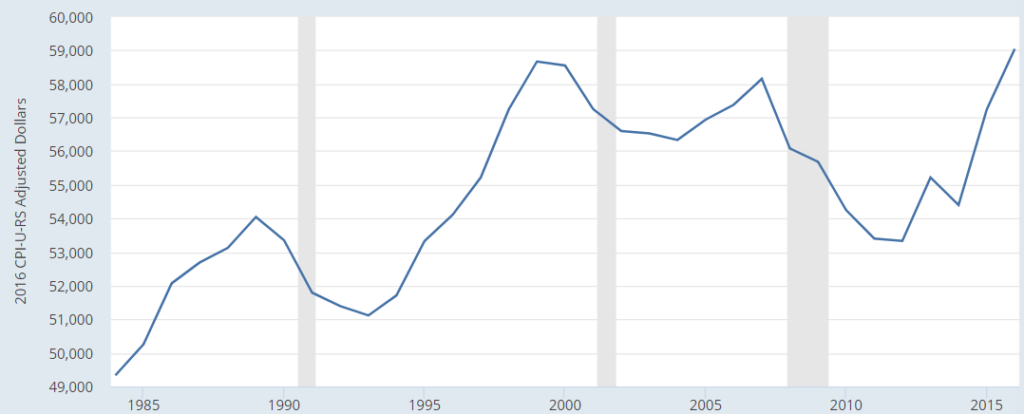

We believe that the economic data showing overall rises in wealth and income are greatly skewed by the top 20% of income earners and masks the financial stress experience by the bottom 80% of households (Graph 2). A recent study by the University of Minnesota shows that 85% of American Households earn less than $59,000 per year (Graph 3). These households haven’t seen their real incomes increase since the late 1999’s (Graph 4).

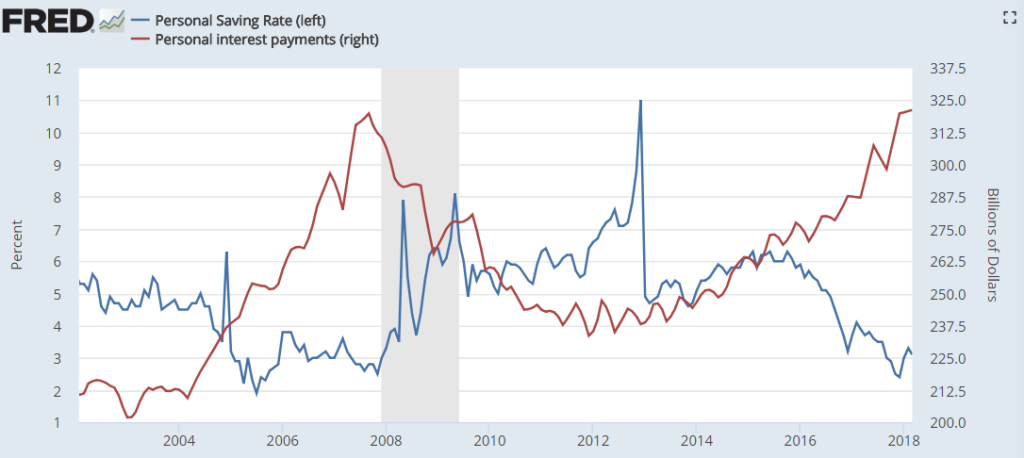

Over the past decade many American households have reduced savings and increasingly turned to debt to fund their lifestyles and major purchases such as autos and College education.

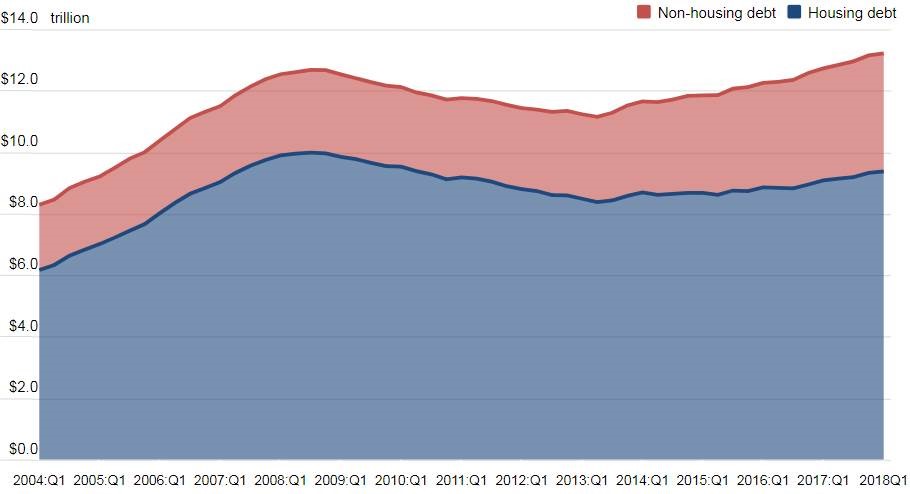

According to the NY Fed (Graph 5), total household debt reached a new peak in the first quarter of 2018 after rising for 15 quarters in a row and now stands at $13.21 trillion. This exceeds the previous peak of $12.68 trillion set during the 3rd Quarter of 2008.

The personal savings rate has been sharply declining since 2015 and coincides with the increase in household debt services payments (Graph 6)

We have not even addressed the demographic headwinds – lack of savings for many planning on retiring in the near future and drop in consumer spending that normally accompanies aging. More on this at another time.

In conclusion: We are less sanguine than the consensus about future economic growth as we witness a rise in financially impaired households.

It is typical late in an economic cycle to have low unemployment, a rising stock market and rising household wealth alongside rising debt.

We will continue to monitor the situation. If the data changes, so will our outlook.

Graph 1 – United States Retail Sales

‘Retails sales had an unexpected decline for 3 months in a row, from December 2017 to Feb 2018’

(Source: U.S. Census Bureau)

Graph 2 – United States Wealth Distribution

‘overall rises in wealth and incomes are greatly skewed by the top 20% of income earners’

(Source: Credit Suisse)

Graph 3 – United States Household Income Brackets and Percentiles

‘85% of American Households earn less than $59,000 per year’

(Source: ASEC Data, IPUMS-CPS University of Minnesota)

Graph 4 – Real Median Household Income in the United States

‘85% of American households haven’t seen their real incomes increase since the last 1999’s’

(Source: St. Louis Fed)

Graph 5 – Total Household Debt

‘total household debt reached a new peak in the first quarter of 2018 after rising for 15 quarters in a row’

(Source: New York Fed)

Graph 6 – Personal Saving Rate and Personal interest payment

‘The personal savings rate has been sharply declining since 2015 and coincides with the increase in household debt services payments as a percent of disposable income’

(Source: St. Louis Fed)